2022 Grains, oilseeds, and pulses outlook update: Canada’s low stocks and dollar to strengthen crop prices

Wednesday, October 12, 2022

Reference: FCC

This is the last quarterly update to our 2022 Outlook for major crops published in January. Over the next three weeks, we’ll update our Outlooks for dairy and cattle and hogs.

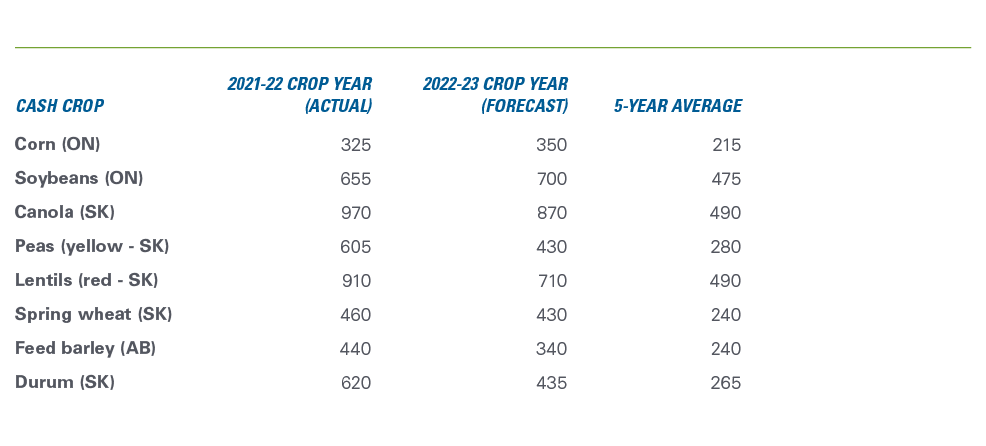

This is the last quarterly update to our 2022 Outlook for major crops published in January. Over the next three weeks, we’ll update our Outlooks for dairy and cattle and hogs.With the 2022-23 marketing year (MY) crop now mostly in the bins, we expect another year of excellent crop prices. While several crop prices fell slightly below our last forecast for the 2021-22 year (soybeans, canola, lentils and durum), each crop price ended well above their respective 5-year average (Table 1). Our forecasts show that will also be the case in the 2022-23 MY, but with most prices falling from the highs of the 2021-22 crop year.

Table 1: Expect record-high prices ($/tonne) of 2021-22 crop to fall in the upcoming MY

Source: FCC calculations

Those excellent prices will continue to support profitability across the country. Western crop margins are expected to remain strong throughout the fall marketing season. In the East, corn and soybeans will be positive, and while winter wheat will face more pressure, they’re also expected to remain positive.Demand remains the key driver in global crop production markets

The 2021-22 crop year faced considerable uncertainty with the Russian invasion of Ukraine throwing commodity markets into chaos. Throughout the year, we’ve monitored the impacts of both the geopolitical instability and what has turned out to be persistent global inflationary pressures on crop profitability. But a third factor has been the combination of low beginning stocks and high global demand for most crops, a supply-demand imbalance that could best be offset by a good northern hemisphere harvest of the 2022-23 crop. That has happened, but only to a certain extent across major field crop production this year.Coarse Grains

The USDA estimates global ending stocks of total grains for the 2021-22 MY will have fallen marginally year-over-year (YoY), as increases in both production and total supply negate a large increase in demand (Figure 1). The stocks-to-use ratio shows a corresponding uptick for the year that’s expected to dissipate in the coming crop year. As a result, grain carry-out stocks are also expected to shrink 3.4% YoY in 2022-23... Read MoreSign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.