2022 Grains, oilseeds, and pulses outlook update: Prices soar due to war in Ukraine

Monday, May 9, 2022

Reference: FCC

This is the first of three quarterly updates to our 2022 Outlook for major crops published in January. Over the next two weeks, we’ll update the Outlooks for dairy and cattle and hogs.

This is the first of three quarterly updates to our 2022 Outlook for major crops published in January. Over the next two weeks, we’ll update the Outlooks for dairy and cattle and hogs.Despite recent events, major trends to monitor in 2022 have not changed: inflationary pressure on input prices, geopolitical tensions, and global trade; that said, the Russian invasion of Ukraine has changed how we need to analyze these trends and manage the risks associated with them.

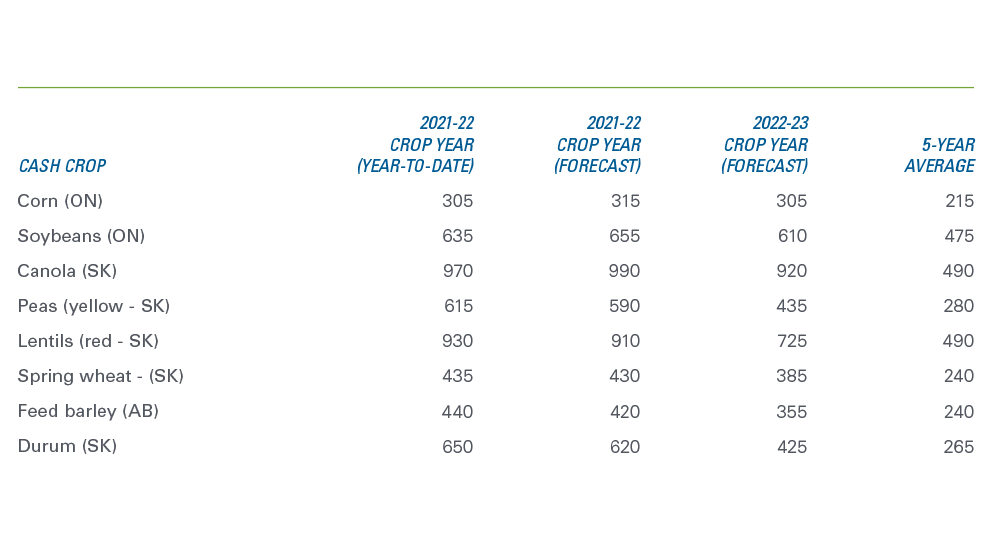

Our current forecasts show prices will remain strong for the rest of the marketing year (Table 1). Some prices will ease off their recent highs, while canola, corn and soybean prices should increase. Recent news from the US on the decision to extend the usage of E15 gasoline this summer provides an additional boost to corn prices.

Table 1: Old and new crop prices ($/tonne) continue to exceed early expectations

Source: FCC calculations.

Ag commodities prices continue to rise

The invasion plunged global grain markets into a state of chaos. As we highlighted in early March, Ukraine and Russia are major exporters of many grains and oilseeds, particularly wheat, corn, rapeseed/canola and sunflower oil. Western sanctions and logistics issues are limiting old crop exports from these regions. The war raises many questions about the new crop: how many acres can be seeded this spring? If seeded, how much will be available to harvest? Will producers be able to get harvest completed? Without answers to these questions, combined with uncertainty about input and labour availability, it is understandable why ag commodity markets have been so volatile. The situation has left traditional buyers of Ukrainian and Russian commodities scrambling for alternative suppliers, causing prices to surge... Read MoreSign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.