2023 Economic year in review

Wednesday, December 13, 2023

Reference: FCC

Headlines in 2022 featured inflation almost daily, and hopes, at the start of 2023, were that inflation would ease enough to convince the Bank of Canada not to raise interest rates and continue with the aggressive rise in interest rates from 2022.

Headlines in 2022 featured inflation almost daily, and hopes, at the start of 2023, were that inflation would ease enough to convince the Bank of Canada not to raise interest rates and continue with the aggressive rise in interest rates from 2022.That hope faded. In agriculture, Western drought and Eastern excess moisture compounded a year of lower crop prices and higher feed prices in drought-stricken areas, as the Eastern hog sector faced a perfect storm of margin challenges and the cattle sector saw escalating prices.

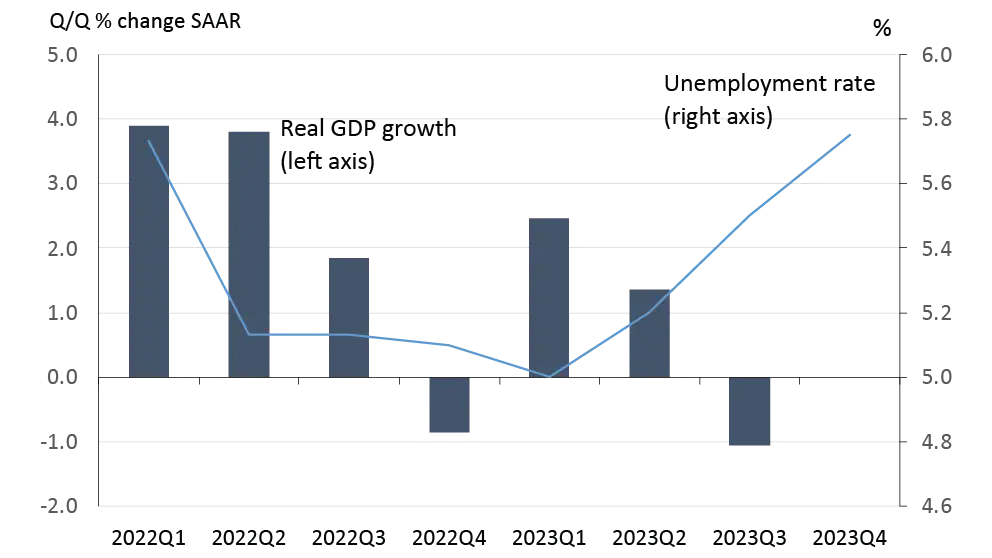

The macroeconomic context

With inflation on selected food items still climbing in late 2022 after a tumultuous year and at speeds that outpaced the overall inflation rate, January 2023 heralded the new year with more uncertainty about the cost of living. The Bank of Canada (BoC) started the year by announcing a 25-bps rate increase, bringing the overnight rate to 4.5%. The brief scare in March after small U.S. banks teetered close to collapse hinted at possible rate cuts, but in July, the BoC raised its overnight rate to 5.00%, warning another hike later in the year was possible. The central bank was concerned about the persistence of core inflation despite a sharp slowdown of real Gross Domestic Product (GDP) growth and a rising jobless rate.

Figure 1: Economic slowdown caused jobless rate to surge

Source: Statistics Canada

By November, the loonie had dropped to a multi-year low of around 72 cents thanks to the strength of the U.S. dollar, the latter driven by a hawkish Fed and its safe haven status during geopolitical turmoil. That wouldn’t help Canada, where inflation ended the year well above the BoC’s 2% target.

Crop production

The sector had done well in 2022, especially compared to the drought-ravaged 2021-22 marketing year (MY), with farm cash receipts of $95.2 billion, a year-over-year (YoY) 14.6 % increase from higher crop prices. About midway through the 2022-23 MY, FCC Economics’ February projections for 2023 [DS1] seeded acres indicated wheat acres would increase, but acreage for other crops would either fall (corn, canola, durum and lentils) or stabilize (soybeans, peas, oats and barley). Global wheat supplies were still low, and there was enough uncertainty about whether the Black Sea Grain Initiative would be renewed for the upcoming crop year. While FCC was projecting generally lower YoY commodity prices for the rest of 2023, there was a bright side. We also expected continual declines in fertilizer prices[DS2] at even faster rates, which meant the crop-to-fertilizer price ratio was expected to improve throughout 2023.

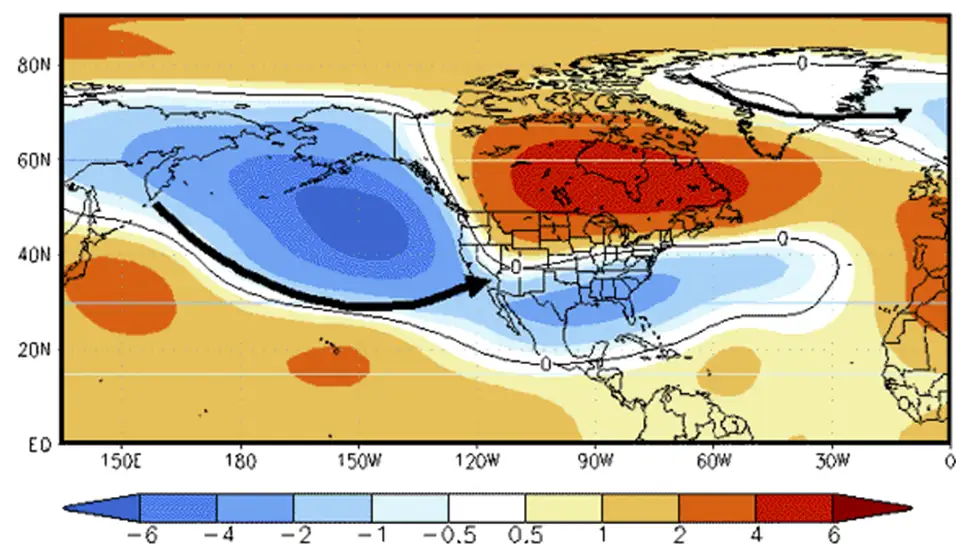

As 2023 progressed, Russia suspended its participation in the Black Sea Grain Initiative, but the news failed to rouse markets, and extreme weather conditions dominated headlines. Attention was focused on Alberta’s growing season starting drier than normal. By June, FCC’s estimate of canola production projected a loss of 3.6 million tonnes; all wheat yields were projected to drop, reducing the crop by 5.6 million tonnes from initial projections. StatsCan’s November outlook estimated total grain and oilseed production 6.8% lower YoY. Worsening the outlook, a global El Niño weather pattern lacking sufficient precipitation to address widespread dryness was expected to return.

Figure 2 illustrates the likely higher-than-normal pressure in Canada over the winter in 2024. With that, there will be relatively milder and drier than normal weather (the map’s red areas).

Figure 2: Forecasted El Nino atmospheric impacts on North America in 2024

Source: Environment Canada

Cattle

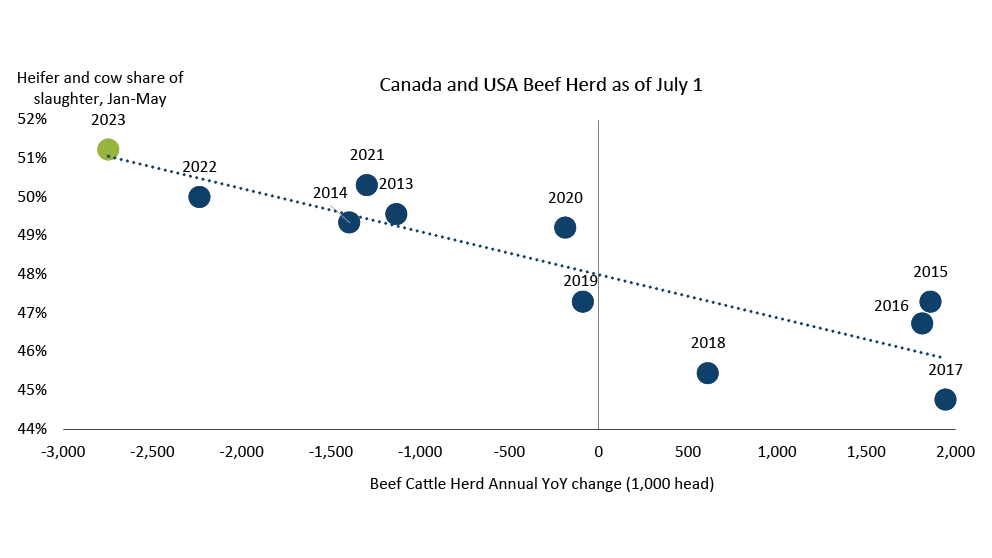

As of January 1, 2023, Canada’s beef cattle inventory had declined 2.2% YoY, a trend seen in the U.S. with a 4.0% YoY loss, as the North American sector staved off high feed costs and drought impacts by culling cattle. The strategy held implications for the long-term vitality of the industry. Not surprisingly, between March 2022 and March 2023, prices increased YoY for cattle.

By July 1, the 2.9% decline in the overall size of the North American beef herd was the biggest year-over-year drop in the last 30 years, as cows and heifers continued to show up as an increasing percentage of total cattle slaughter (Figure 3).

Figure 3: The North American cattle herd shrinks again

Sources: Canfax, Statistics Canada, USDA, FCC Calculations

At the same time, feed prices were still high. In May, local Alberta hay prices were 20% above 5-year averages and were expected to remain elevated throughout 2023. Feedlots were sourcing feed grains more proactively in 2023 compared to the 2021/2022 marketing year, as the Canadian drought worsened. By August, they’d already purchased nearly 250,000 mt of corn for delivery in September. Despite the high prices motivating producers to build the herd, the conditions prompted producers to continue sending heifers to feedlots.

Hogs

In February, Olymel announced the first of four plant closures in 2023. In March, Les Éleveurs de porcs du Québec approved a “voluntary withdrawal tool” to manage the anticipated glut of hogs. Facing 15% less processing capacity due to Olymel’s shutdowns, the sector elected to institute a producer-paid levy paid to producers who voluntarily quit production to reduce the total number of hogs sent to market. Between March 2022 and March 2023, hog prices dropped roughly 13% YoY and were expected to remain depressed throughout the year.

Federal plant hog slaughter rates through Q3 were up YoY, with eastern plants slaughtering 1.5% fewer hogs and western plants up 2.8%. Eastern plants were also slaughtering relatively lighter hogs – a direct consequence of the herd reduction program in Quebec. The region’s greater export of live hogs to the US (to avoid Canadian processing) was causing a short-term Eastern supply gap forcing slaughters of younger animals, resulting in lower pork production.

Pork affordability relative to beef and chicken had improved, and Canadians consumed more pork in 2023, bringing some good news to the beleaguered sector.

Dairy

In October,the dairy sector’s National Pricing Formula suggested a 1.8% increase effective February 1, 2024. With a nod to Canada’s already high food costs, the Dairy Farmers of Canada issued a statement advocating the delay of the annual price adjustment.

Other news

Equipment manufacturers started to deliver on pre-orders, which had been held up during the pandemic due to supply chain issues. FCC forecasted a 40% increase in new combine sales for the fall, with expected sales of other equipment still hampered by supply constraints. The sector could expect strong prices for new front-wheel assist tractors, four-wheel drive tractors, and combines.

With Canada-India tensions escalating, supplies of Canadian potash to one of the world’s largest fertilizer consumers were expected to continue. India’s pulse production faced setbacks, but because Canada is the only reliable supplier of green lentils, exporters were unlikely to be adversely affected. Further restrictions on pulse imports seemed unlikely.

Read More

Sign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.