2023 weather and production challenges limited growth in fruit land values

Friday, May 10, 2024

Reference: FCC

Fresh fruit is an essential part of Canada’s agricultural industry, contributing 2.5% to total Canadian crop receipts. Regionally, fruit's importance is more significant: In Atlantic Canada, fruit contributed 9.1% to crop receipts, and in BC, fruit contributed nearly 19%. Supplementary to our 2023 Farmland Values Report, our analysis aims to highlight trends in land values for the production of blueberries, apple orchards, cherry/tender fruit orchards, and vineyards.

Fresh fruit is an essential part of Canada’s agricultural industry, contributing 2.5% to total Canadian crop receipts. Regionally, fruit's importance is more significant: In Atlantic Canada, fruit contributed 9.1% to crop receipts, and in BC, fruit contributed nearly 19%. Supplementary to our 2023 Farmland Values Report, our analysis aims to highlight trends in land values for the production of blueberries, apple orchards, cherry/tender fruit orchards, and vineyards. We report trends in average price per acre and value ranges for the 5th and 95th percentile values in production areas with sufficient sales data to produce reliable estimates (Table 1). Fruit production occurs in other areas within each province. However, we do not publish land value estimates for those areas because of limited sales activity.

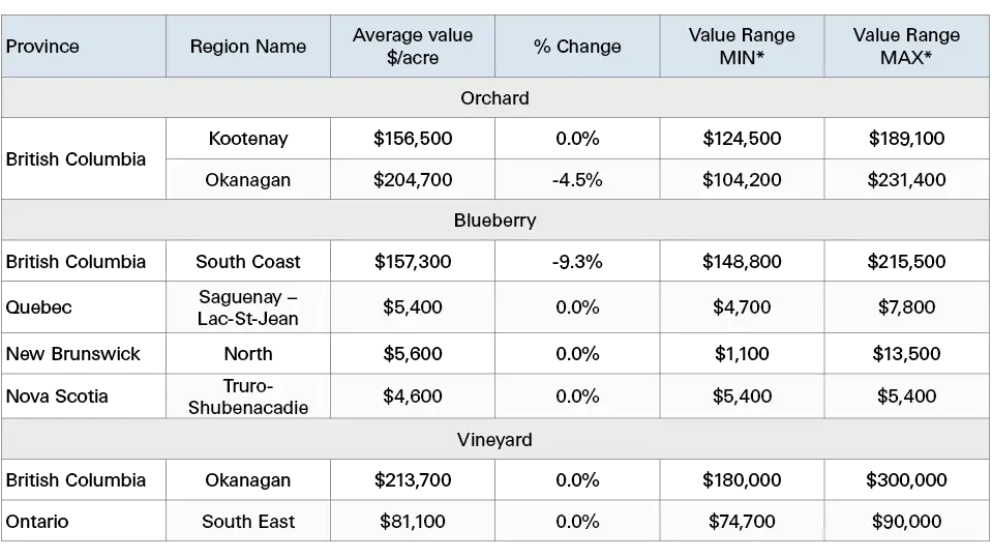

Table 1: FCC reference Value per acre for Orchards, Blueberries and Vineyards

Source: FCC Calculations

*The value range represents 90% of the sales in each area and excludes the top and bottom 5%

British Columbia

The agricultural sector in the Okanagan Valley is currently facing significant weather-related challenges. Recent frost events have resulted in an estimated complete loss of grape and tender fruit crops, and the outlook for cherries remains uncertain, with less than half of the typical crop anticipated. In contrast, apples, known for their resilience, appear to have weathered the frost better than most.Some acreages have changed hands; however, these deals were all agreed upon prior to the extreme cold event in early 2024. Land values have softened and are expected to stabilize to a new normal once the extent of the crop damage is known.

It’s important to note that the impact of weather damage varies considerably across different valleys and fruit varietals, adding another layer of complexity to the situation; there is hope that some pockets may be less affected, but for now, it is too early to tell.

We’re reporting no change this year in the average orchard land values in the Kootenay region, while orchards in the Okanagan region recorded a decline of 4.5%. Vineyards' average values also remain unchanged compared to last year.

Little to no damage is expected to this year’s blueberry crop. The South Coast region acreages recorded a strong rise in values, which peaked in early 2022. Then, they held steady with minimal sales activity as interest rates rose and have since come down from peak levels. Land values appear to have softened, along with a noticeable slowdown in open-handed bidding. Our analysis shows that average land values of blueberry operations declined 9.3% in the South Coast region in 2023.

Ontario

Orchard and tender fruit growers, most of whom are in Niagara, are witnessing a period of robust crop quality and strong fruit prices. Land sales are often happening locally between farmers or long-standing rental tenants. This exchange ensures the land remains productive and within the farming community; however, it limits transparency in the transaction details.Read More

Sign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.