Canada’s unsung exports: A look at the trade performance of products we usually skip

Tuesday, September 20, 2022

Reference: FCC

We spend most of our time discussing the most economically important ag commodities and food items for which data are readily available. But there’s a whole raft of ag, food and manufactured goods we usually skip. This post addresses the oversight, because these bypassed commodities and products contribute significantly to Canada’s strong overall export trade performance. In 2021, the Harmonized System (HS) codes we selected for this analysis accounted for over $31 billion.

We spend most of our time discussing the most economically important ag commodities and food items for which data are readily available. But there’s a whole raft of ag, food and manufactured goods we usually skip. This post addresses the oversight, because these bypassed commodities and products contribute significantly to Canada’s strong overall export trade performance. In 2021, the Harmonized System (HS) codes we selected for this analysis accounted for over $31 billion.Raw ag commodities

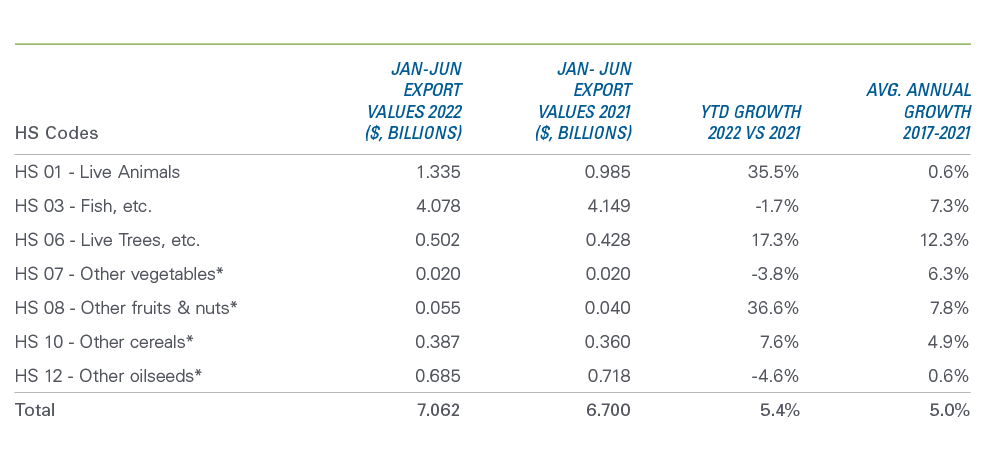

In 2021, Canada’s single-largest ag commodity exports were wheat (HS1001) at $8.3 billion and canola (HS1205) at $6.4 billion. Total exports of ag commodities (includes HS01, 03, 06 – 08, 10, 12) summed to $49.7 billion. Less-often reported ag products account for significant export revenues (Table 1). All product categories show positive average growth between 2017-2021. The pace of exports in 2022 is impressive as YTD exports are 5.4% larger than at the same time last year. One notable exception is for exports of HS03 (seafood). The YTD pace shows a decline of 1.7%, opposite significant growth that averaged 7.3% annually between 2017-2021.Table 1: Strong export growth over the last five years in ag commodities

Source: Statistics Canada Trade Data Online

* HS07 Other vegetables” includes HS0711, 0712 and 0714; “HS08 Other fruits and nuts” includes HS0801 – 0807 and 0812 – 0814; HS10 Other cereals” includes HS1002, 1004, 1006 and 1008; “HS12 Other oilseeds” includes HS1202, 1204, 1206 – 1214.

Food products

Canada’s food exports (HS02, 04, 05, 09, 11-13, 15-23, 41) totaled $42.9 billion in 2021. Our largest food exports — fresh, frozen and chilled beef and pork — accounted for $8 billion. Another $4 billion came from exports of HS23 (Residues and waste of the food industries) and $1.3 billion from offal and pig fat. The U.S., Japan and Mexico were the three largest markets for Canada’s offal and pig fat, with the U.S. taking almost half of those exports. The U.S. and China account for $3.3 billion of the $4 billion HS23 exports.Averaging over half a billion dollars between 2016 and 2020, annual dairy product exports grew yearly between 2016 and 2020, then dipped in 2021 with YoY -17.0% growth. But 2022 YTD pace of exports rebounded at 28.3% (Table 2). Most other categories show strong YTD performance in 2022. HS23 also saw continuous growth between 2015 and 2021, yet growth in 2022 is smaller YTD than its 5-year average. Only the smaller categories “other meats” and “raw hides” lag 2021’s pace, a trend observed for multiple years. Exports of other meats (lamb and horse) from HS02 and raw hides (HS41) declined significantly, with meat falling 64.9% in total from 2015 to 2021 and hides falling 42.6%... Read More

Sign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.