Canadian food manufacturing’s opportunity to sustainably feed a growing population

Tuesday, August 27, 2024

Reference: FCC

With the world population now over 8 billion and nearly 10 billion expected by 2050, demand for food is not slowing down. In fact, estimates for a 2050 population of 9.1 billion from the Food and Agriculture Organization (FAO) predict agricultural production needs to increase by 60% over 2005 levels to feed the world’s growing population. The challenge is producing more food using the same or fewer inputs.

With the world population now over 8 billion and nearly 10 billion expected by 2050, demand for food is not slowing down. In fact, estimates for a 2050 population of 9.1 billion from the Food and Agriculture Organization (FAO) predict agricultural production needs to increase by 60% over 2005 levels to feed the world’s growing population. The challenge is producing more food using the same or fewer inputs.We previously explored productivity in agriculture. Now it’s time to turn our focus to the critical role food manufacturing plays in transforming raw materials into food products.

Food manufacturing is a big deal in Canada

Food is the largest manufacturing sector in Canada by employment and sales, and one that has plenty of potential. Abundant land and water resources and a strong global reputation of safe and high-quality food present an opportunity. However, the sector needs to adopt new technologies to support a qualified labour force to boost productivity.Productivity increases when output increases at a faster rate than working hours

Simply put, productivity measures how well we turn inputs into outputs. The most common measure is labour productivity, which measures gross domestic product (GDP) per hour of work, adjusted for inflation. Improving productivity can help stabilize the food supply and prices, strengthen businesses, and make Canada more competitive in the global market.However, increasing productivity isn’t easy and there’s no single solution that works for every sector. Productivity growth takes a combination of efficiency, economies of scale, and innovation all working together to produce more output with the same or less inputs.

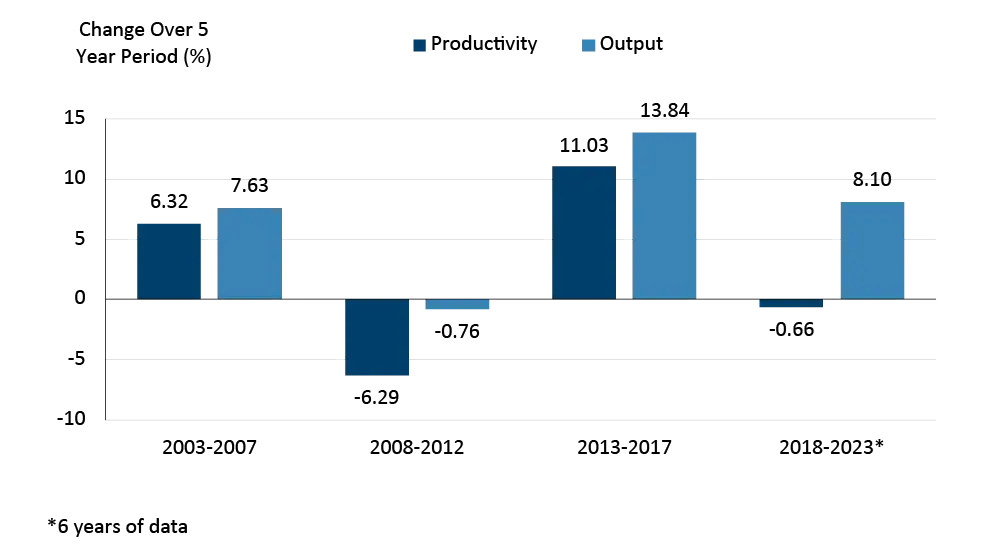

One hour of work producing more food in 2023 than 2003

Over the past 20 years, food manufacturing became more productive, allowing us to produce more food in less time.After a period of growth in the early part of the century, the industry faced challenges between 2008 and 2012 that impacted productivity. The Canadian dollar strengthened against the US dollar, which was good news for some, but not the export-oriented food manufacturing sector. The U.S., Canada’s largest market for exported food, now had to pay more for Canadian goods, reducing Canada’s price advantage. Jobs were cut, businesses were shutting their doors and output declined by 0.76% after years of strong growth (Figure 1).

Looking back, the industry went through significant changes. Companies consolidated, invested in new technologies and automation and adjusted their operations to compete while the Canadian dollar was strong. In the following five years, productivity grew by 11%, due somewhat to a weakening Canadian dollar but also the changes made through the hard years. Since then, productivity growth has remained relatively flat.

Figure 1: Food manufacturing productivity rebounded after a slump between 2008 and 2012, but remains flat in recent years

Source: Statistics Canada

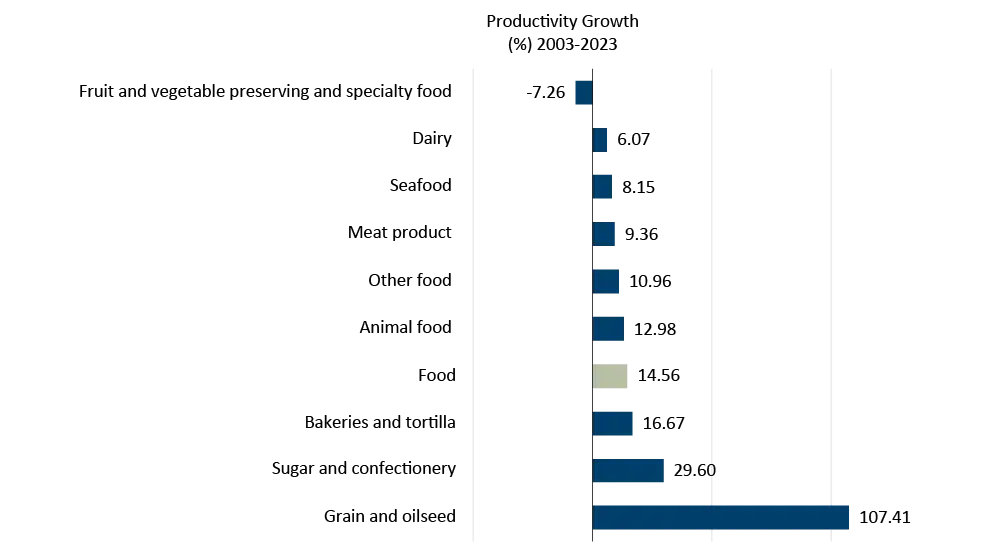

Grain and oilseed milling leading the way in sub-sector productivity growth

The grain and oilseed milling industry stands out, doubling productivity in the last twenty years (Figure 2). This is mainly because oilseed crushing grew rapidly over this period, with canola seeds crushed increasing over three times to nearly 11 million tonnes in 2023. The Canola Council of Canada announced another 6.7 million tonnes of processing capacity by 2025. This should help the industry meet the global demand for canola oil and meal and keep productivity growing.On the other hand, fruit and vegetable preserving and specialty food manufacturing struggled to grow productivity between 2003 and 2023 (Figure 2). This sector is diverse with many small and medium businesses, ranging from baby food, to ketchup, and frozen vegetables. Businesses are usually labour intensive, dragging down productivity, but have competitive pay and an opportunity to develop innovative products to meet evolving consumer demands across a wide range of product categories.

Figure 2: Productivity growth stories differ across sub-sectors

Source: Statistics Canada

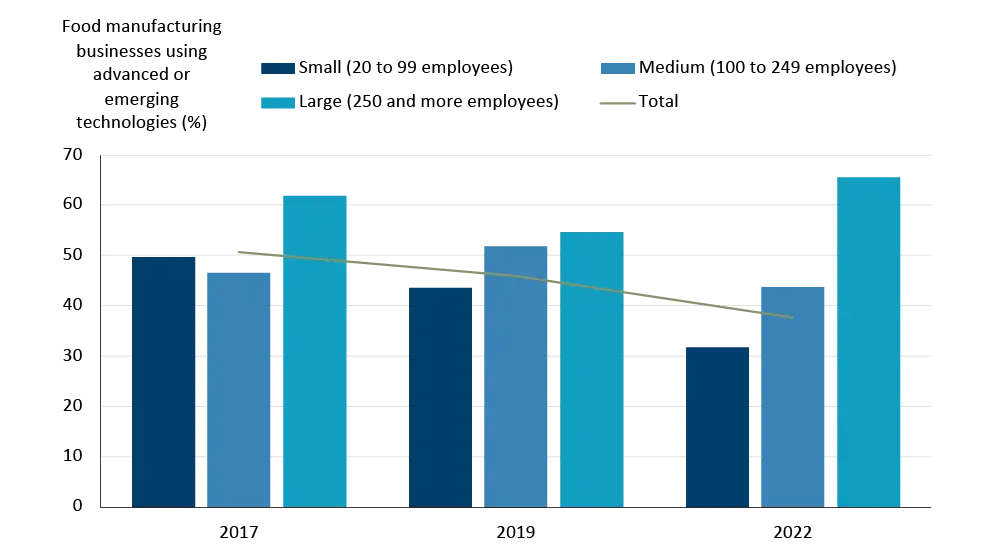

Setting up for success

The full potential and cost that the fourth industrial revolution – the era of smart manufacturing and digitization – is still uncertain which can cause hesitation in investment. However, if it’s anything like the first three industrial revolutions, the industry should take note. Just as steam, electricity, and the internet propelled us to produce more with fewer inputs, automation, robotics, artificial intelligence, and blockchain are shaping up to do the same. Output and labour efficiency improvements from these technologies can manage inventory, prevent unplanned downtime, forecast demand, track production and ensure quality control.Many businesses are already using new technologies (Figure 3), but fewer are doing so since 2017, particularly small businesses. Many don’t see these technologies as relevant or necessary, suggesting that the return on investment (ROI) isn’t enough. To navigate the wide range of new and evolving technologies, professional services such as accountants and engineers are helpful in developing a successful business plan with high ROI. A good option for small businesses is to look for technology products that offer pricing structures that are scalable, for example price per sensor, to more easily customize to the business size. For sustainable long-term use, the technology must integrate into current business practices and consider each operation’s unique needs.

Figure 3: Food manufacturing businesses starting to use advanced and emerging technologies

Source: Statistics Canada

Bottom line

There is potential for food manufacturing in Canada to increase productivity and help sustainably feed a growing population. Businesses need to be ready to compete in the markets of tomorrow and manage external factors, such as fluctuations in exchange rates, by managing efficiency, looking at scaling-up opportunities, and adopting new technology. By doing this Canada’s place as a global leader in sustainable food production will continue to grow, which is a benefit to all Canadians.

Read More

Sign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.