Canadian planting is underway – what will producers sow?

Friday, May 3, 2024

Reference: FCC

Seeding is underway across Canada and the United States. Even with global ending stocks of corn and soybeans increasing this year resulting in softer prices, changes to producer seeding intentions are expected to be minimal despite potential impact to yields from reduced winter moisture conditions for Western Canada. Yet, there are strong price signals from international demand including India for pulses which could shift acres and bring marketing opportunities ahead for other crops as well. This outlook highlights seeding intentions of Canadian producers and what lies ahead for the growing season for markets and trends to monitor.

Seeding is underway across Canada and the United States. Even with global ending stocks of corn and soybeans increasing this year resulting in softer prices, changes to producer seeding intentions are expected to be minimal despite potential impact to yields from reduced winter moisture conditions for Western Canada. Yet, there are strong price signals from international demand including India for pulses which could shift acres and bring marketing opportunities ahead for other crops as well. This outlook highlights seeding intentions of Canadian producers and what lies ahead for the growing season for markets and trends to monitor. Key observations

- Minimal acreage changes expected from initial seeding intentions

- Weaker corn and soybean prices send signal to farmers in North America to reduce planted acres

- Dry conditions in Western Canada equate to more seeded acres but potential impact on yields

Minimal acreage changes expected for Canadian producers

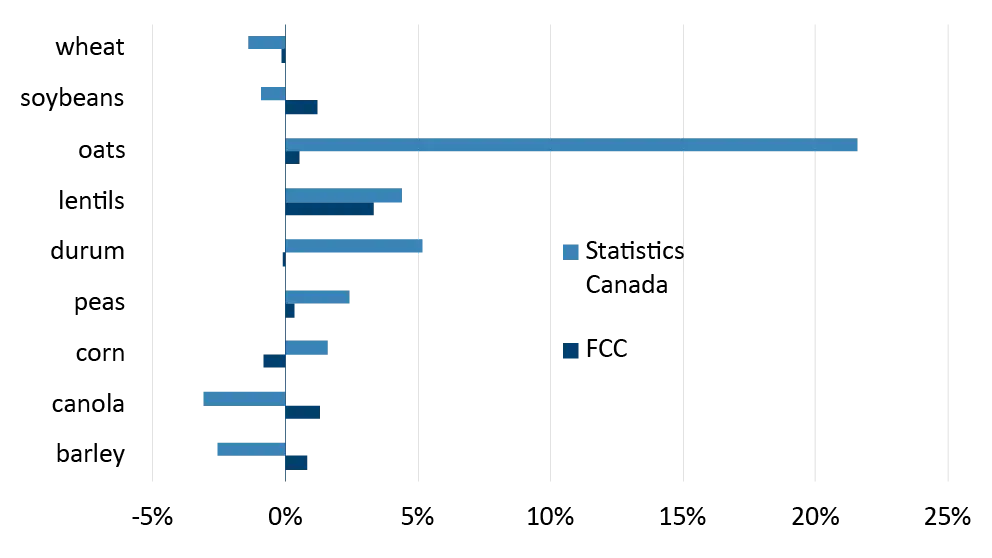

Planting decisions have been finalized and growers are either already planting or will be in the coming weeks. Overall, we anticipate Canadian farmers will have minimal acreage changes compared to last year as most stick to their typical rotations of corn-soybeans in the east and canola-wheat in the west (Figure 1). Any acreage surprises would be predominantly in pulses.Figure 1: Projected 2024 seeded acreage changes expected to be minimal

Sources: Statistics Canada, FCC calculations

FCC seeding intentions differ from Statistics Canada, yet both projections are possible. It is important to note Statistics Canada’s survey was conducted during this past December and January. Since then, crop prices have continued to decline, fertilizer prices have trended higher, drought has persisted in Western Canada, and crop insurance price levels have been released, all of which may have changed producers’ minds.

Farmers are expected to plant 1.3% more acres of canola this year, which contrasts with Statistics Canada’s 3.1% projected decline. Historically producers understate survey intentions for canola (e.g. last year’s survey underestimated actual seeded acres by 500,000 acres). Furthermore, farmers may expect basis levels to improve, strengthening current lean profitability projections, as additional crush capacity comes online.

All-wheat acres (excluding durum) and other coarse grains are anticipated to be unchanged to slightly lower this year. Wheat and coarse grains have been pressured by declining commodity prices with more support to competing oilseed and pulse crops. Both oats and wheat acres could see potential shifts as oats typically have lower crop inputs associated with them and wheat has generally performed better during past droughts.

Strong pulse prices are expected to attract acreage shifts. Lentil acreage is expected to increase 3.3%, while dry peas are projected slightly higher at 0.3%. Pea acreage could expand more than we are projecting given strong price signals, and the relatively low fertilizer costs associated with growing the crop and its resilience amid drought conditions.

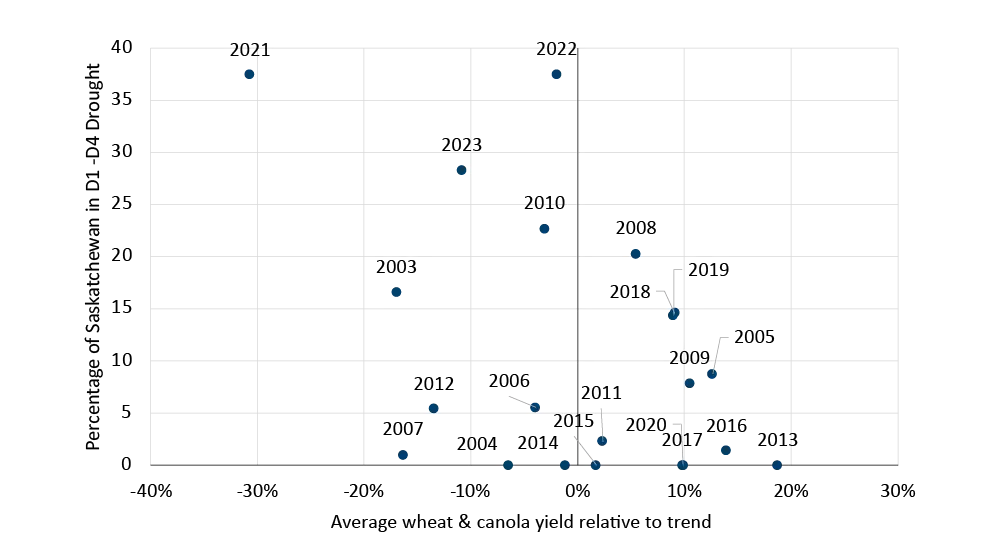

Drought impacts on Western Canadian yields

At the end of March, 82% of the country's agricultural landscape was classified as abnormally dry or in moderate to exceptional drought, with nearly all prairie farmland falling under it. Moisture deficits during seeding typically result in additional acres as producers go through sloughs and potholes, but it does mean in season rainfall becomes even more important. Last year, this was largely the case in Western Canada which helped contribute to overall production being better than expected.Saskatchewan was 91% covered by drought at the end of March, an outlier compared to the last 20 years, even 2021 and 2022 had lower levels at this stage (Figure 2). However, in season rainfall makes a big difference like during 2022 which resulted in near trend yields but continued dryness can impact yields like in 2021. Historically, crops like canola, durum, and lentils have higher yield impacts due to drought compared to crops like wheat, barley, and peas. Alberta and Manitoba trends are not so cut and dried as Saskatchewan, but obviously low soil moisture will be impactful in those areas.

Figure 2: March drought impact on Saskatchewan average canola and wheat yields relative to trend

Sources: Statistics Canada, FCC calculations

The wildcard that could change those projections is timely rains throughout the growing season. Because in-season rains can turn prices in either direction the futures market will be cautious as the season progresses. A dry summer could also mean an even earlier harvest as crops reach maturity sooner.

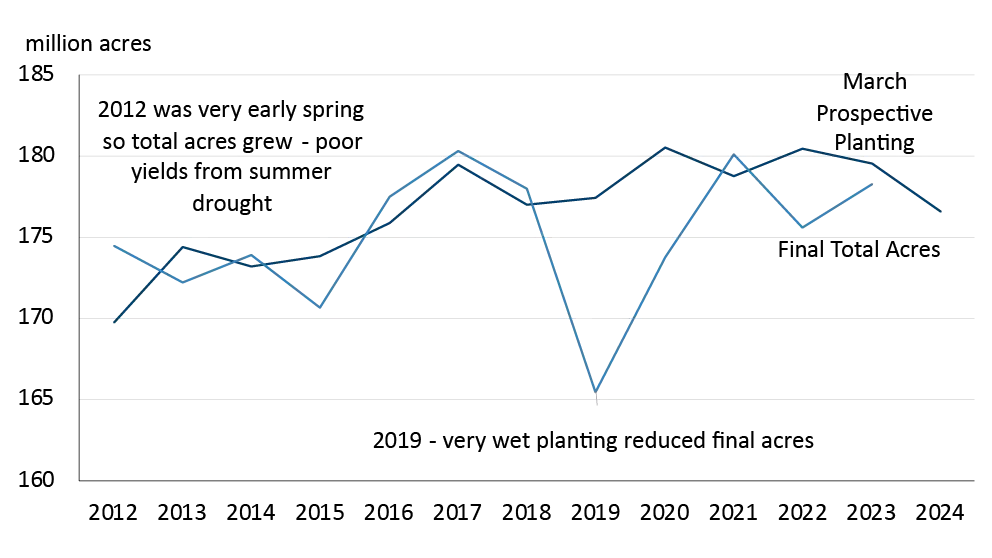

U.S. planted acres are an important driver for Eastern Canadian prices

Markets are always watching supply and demand fundamentals, and their impact on prices. Global supplies of corn and soybeans are currently plentiful with the focus currently on southern hemisphere production and the U.S. winter wheat crop which is in generally good condition.American farmers are expected to plant 90 million acres of corn and 86.5 million acres of soybeans this year according to the United States Department of Agriculture’s prospective planting report. The report was neutral to bullish for grain and oilseed markets with a 6.3 million acres reduction in principal field crops from 2023, and 3 million fewer corn and soybean acres (Figure 3). While most of the reductions are in states that have been experiencing drought, announced reductions in the Midwest seem like a stretch to us considering the region has been profitable and has good soil moisture. In other words, actual acres could end up higher than intentions.

Producers ultimately plant more or less corn and soybean acres depending on spring weather. 2019 is an example where final acres ended up well below March intentions due to excess moisture at planting while acres grew in 2012 due to the early, dry spring. If planting goes well, American farmers tend to increase corn acres more often than soy acres.

Figure 3: USDA corn and soybean combined planted acres

Source: USDA

What could be the impact to commodity prices? Well, assuming the intended acreage turns out to be accurate, the focus of markets will be on the weather with any potential issues pressuring prices. While not all Canadian producers grow these crops, corn helps set the world price for other grains like wheat, barley, and oats, while soybeans have a major influence on canola.

Read More

Sign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.