Dairy product manufacturing: 2024 FCC Food and Beverage Report

Monday, June 3, 2024

Reference: FCC

The following information is from the 2024 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. To get the big picture read the full report.

The following information is from the 2024 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. To get the big picture read the full report.Increased demand paving the way for further production

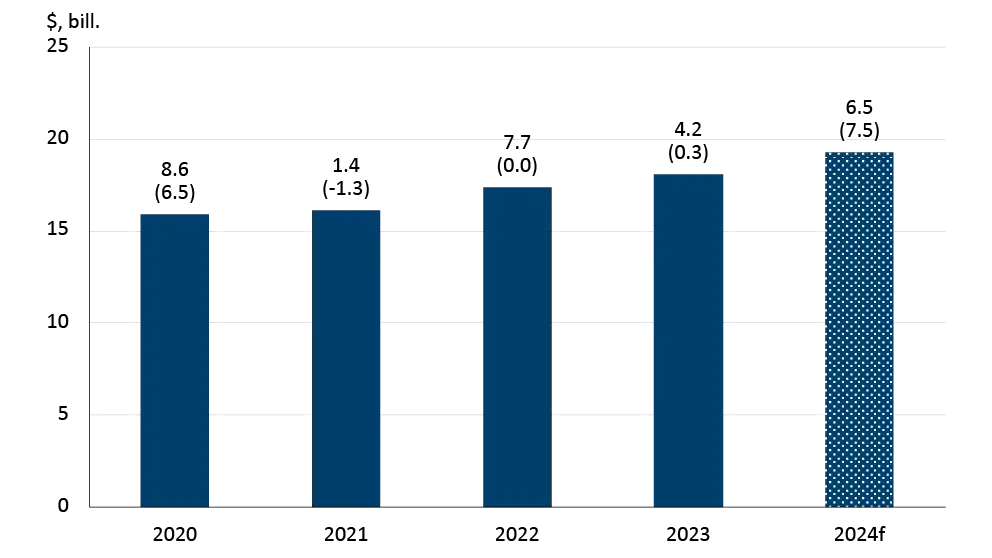

Dairy product sales are projected to have a strong year, with sales and volumes forecasted to grow by 6.5% and 7.5%, respectively, in 2024 (Figure 1). Milk production increases at the farm level have already been announced for 2024, suggesting that processor – and, therefore, retail – demand for dairy products will expand.

Figure 1: Dairy product sales and volumes expected to have a strong year in 2024

Total sales (in $, billions) are on the y-axis. The top number above each bar is the year-over-year growth in sales measured in dollars. The bottom number above each bar (in parentheses) is the year-over-year growth in volume sold. Volumes are reported sales deflated by a price index (January 2020 = 100.

Sources: FCC Economics, Statistics Canada

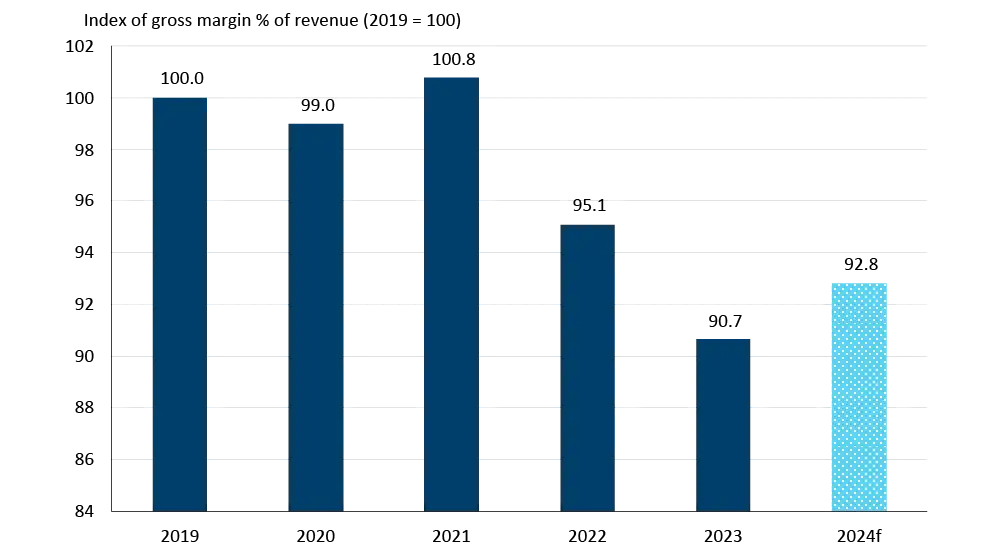

Dairy product profitability has been down in the last two years but is set to improve in 2024 (Figure 2) due to higher demand and stabilizing input costs. Raw milk costs will increase effective May 1, when the butter support price will increase the average butter price by 1.3%. Despite improving from last year, 2024 margins will still be lower than between 2019 and 2021.

Figure 2: Dairy product manufacturing margins to improve in 2024

Sources: FCC Economics, Statistics Canada

FCC Economics spotlight: A deeper look at milk and cheese consumption trends

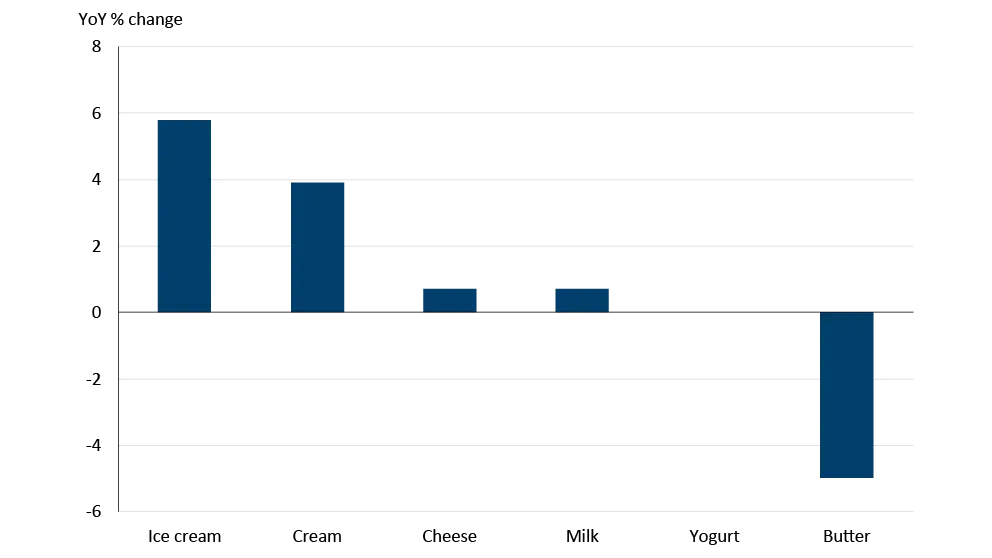

In 2023, sales performance was mixed across product types (Figure 3). Ice cream consumption, for example, was up 5.8% in 2023, while butter consumption was down -5.0%. It's worth noting that milk and cheese remained price competitive in 2023: milk and cheese prices increased 1.9% and 2.4%, respectively, in 2023, both below the increase in total grocery prices (4.7%) and many other major food products.

Figure 3: Consumption of dairy products differed by product in 2023

Consumption over the last 12 months ending December 2023 compared to the 12 months ending December 2022.

Source: Canadian Dairy Commission

Fluid milk consumption – in total, and on a per capita basis – has been declining for decades. Despite recent trends, about 25% of milk (by volume) goes into fluid milk production. Full-fat, ultra-filtered, lactose-free and high-protein milk varieties have been gaining popularity in recent years and will continue to do so into 2024.

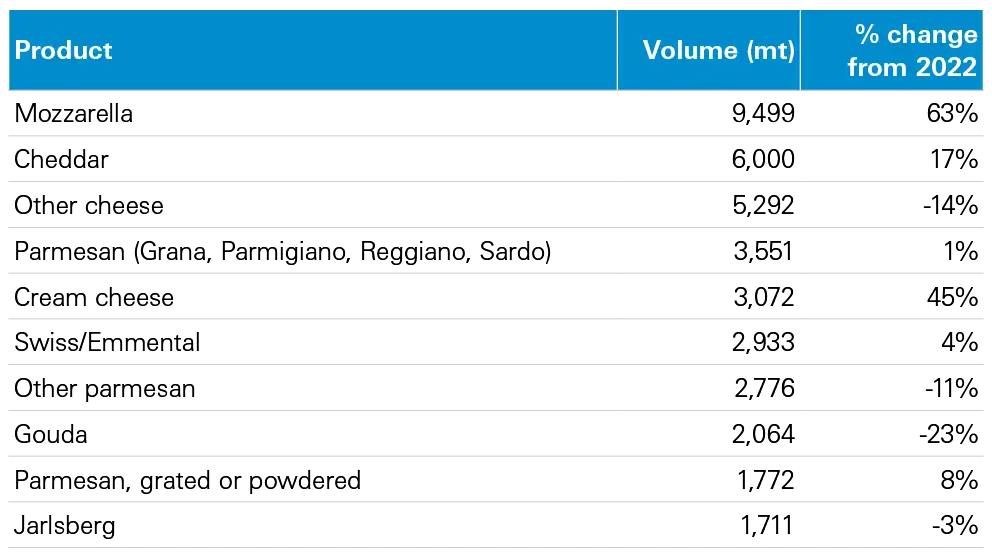

Cheese accounts for another 25% of milk usage (by volume), so trends here are also important to monitor. While detailed data on cheese consumption are scarce, we can use import data as a proxy to account for shifts in consumer preferences in 2023 following high food price inflation and changing demographics (Table 1). Mozzarella and cheddar are still the leading cheese imports and saw growth in 2023, while other more specialized cheeses (parmesan, Swiss/Emmental, gouda, Jarlsberg) recorded limited or negative growth. One thing to note is Canada's various trade agreements allow for incremental increases in tariff-free access each year, meaning that the total permitted tonnage of cheese imports increases yearly.

Table 1: 2023 top 10 cheese imports

Source: CIMT Database

Other trends to monitor in 2024

In 2023, dairy price inflation was lower than many other food products, and in 2024, dairy product price inflation is forecast to be low. This positions dairy products to have a relative price advantage in the grocery aisle, which supports demand.

Full-fat and ultra-filtered/protein-added milk are increasingly popular, even as per capita milk consumption has declined.

The number and variety of cheeses available to Canadian consumers are increasing yearly, but consumers still demand long-established types (mozzarella and cheddar).

Wage growth offered by dairy product manufacturers was high last year (9.2%). We expect this to slow alongside a declining job vacancy rate.

Read More

Sign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.