Economic headwinds for the agricultural equipment market

Thursday, June 13, 2024

Reference: FCC

This outlook highlights key trends for Canadian manufacturers of agricultural equipment as the pre-order season for the 2025 production line approaches while keeping an eye towards 2026.

This outlook highlights key trends for Canadian manufacturers of agricultural equipment as the pre-order season for the 2025 production line approaches while keeping an eye towards 2026. Key observations

- Canadian manufacturing sales (nominal) are projected to decline 2.2% in 2024

- Slow sales growth in the years ahead due to lower farm profitability

- Economic slowdown points to slower growth rate on raw material and labour costs

- Growing U.S. protectionism could impact steel and agricultural markets

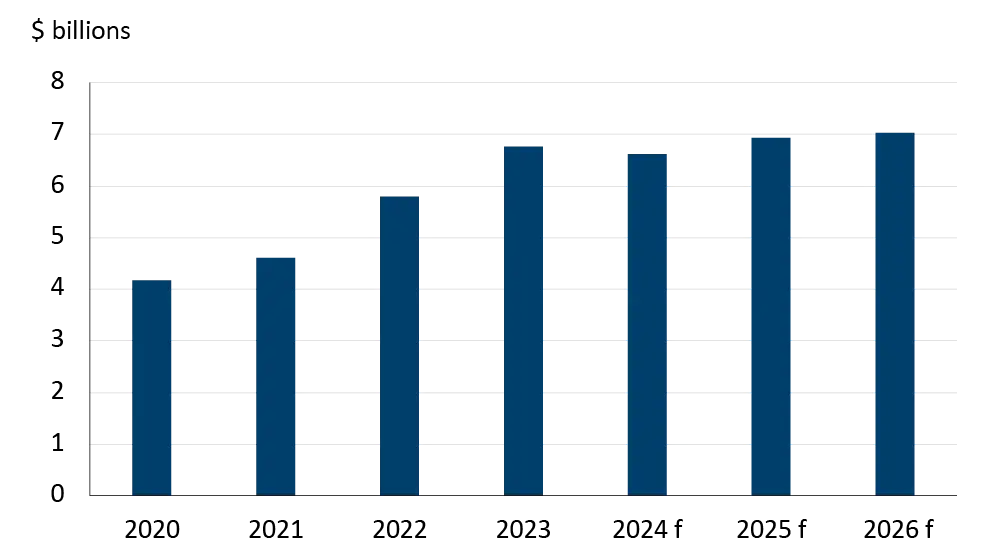

The Canadian agricultural equipment manufacturing sector experienced softer sales through the first quarter this year. Sales declined 5.1% from the same period in 2023 but remain above historical levels (Figure 1). Our latest projections suggest sales will decline -2.2% this year, a significant revision down from our earlier estimate of an 8.4% increase. The decline is due to tighter farm profitability, high equipment prices, and elevated interest rates. While sales are projected to dip this year, growth is expected to resume in the years ahead as farm profitability improves.

Figure 1: Canadian agricultural equipment manufacturing sales

Sources: Statistics Canada, FCC calculations

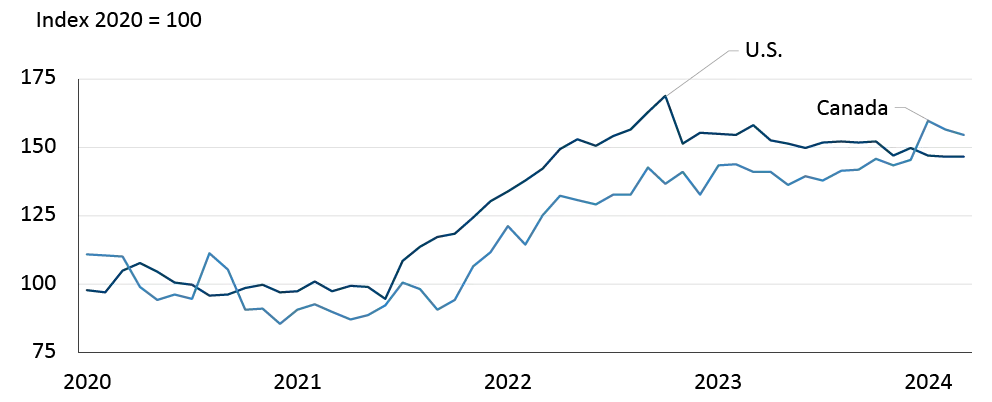

A slowdown in Canadian sales this year was always in the cards. For starters, large U.S. agricultural equipment manufacturers had already begun to curtail production in response to declining demand. It was just a matter of time before the same happened north of the border as well. Also, sales trends between Canada and the U.S diverged following the pandemic (Figure 2), with 2023 sales surging this side of the border after supply chain issues were sorted out. After such a solid year, a slowdown was inevitable.

Figure 2 : Canadian and U.S agriculture equipment manufacturing sales measured in Canadian dollars

.png)

Sources: Statistics Canada, U.S. Federal Reserve Bank of St. Louis

Higher equipment prices, as opposed to volume, are largely responsible for U.S. agriculture manufacturing sales growing 20% in the first quarter of the year. However, the large U.S. agricultural manufactures are forecasting approximately 10 to 15% declines in large agricultural equipment sales this year and are accordingly cutting production to keep inventories in line with demand. While U.S. manufacturing inventory values have declined slightly so far this year, they are expected to remain elevated (Figure 3). A similar trend is occurring here as slowing Canadian agricultural manufacturing sales and rising equipment prices have resulted in rising inventories.

Figure 3: North American equipment manufacturing inventory values remain historically high

Sources: Statistics Canada, U.S. Federal Reserve Bank of St. Louis

A positive story amongst the large U.S. manufacturers is that the above-mentioned curtailment in production has allowed them to focus resources on producing equipment that is in high demand (e.g. high clearance sprayers) and reducing the time from order to customer delivery. Canadian manufacturers may be in a similar situation as most are small niche manufacturers.

Other factors to consider

- Canadian dollar and interest rates

- Production costs

Manufacturing outlook: labour and raw material costs

Much like farmers focus on their per acre equipment costs, equipment manufacturers also pay close attention to their costs. Labour and raw materials account for approximately 20% and 65% of total expenses, respectively. Growth in wages paid by equipment manufacturers has trended higher during the first three months of the year with an average growth rate of 5.7%. Wage growth is expected to moderate as the Canadian economy slows, along with potentially increasing the supply of qualified workers available to be hired by for manufacturers.Read More

Sign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.