Mid-year 2022 farmland values puts focus on income, interest rates and supply

Tuesday, October 4, 2022

Reference: FCC

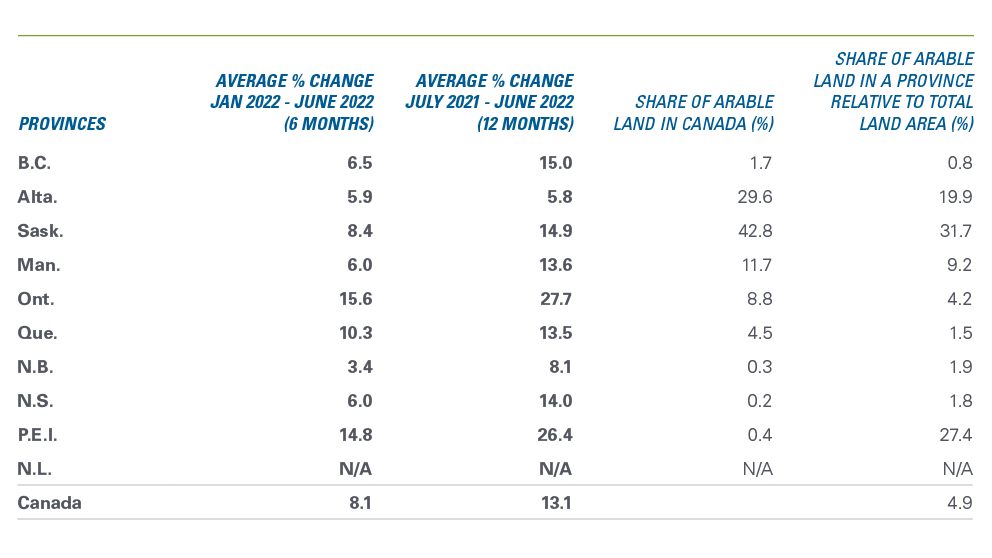

The main drivers of farmland values remained strong in the first half of 2022. We report an average increase of 8.1% nationwide in farmland values over the period (Table 1). Commodity prices were robust, strengthening farm cash receipts. Higher interest rates and elevated farm input prices seemed to have had minimal influence on the demand for farmland.

The main drivers of farmland values remained strong in the first half of 2022. We report an average increase of 8.1% nationwide in farmland values over the period (Table 1). Commodity prices were robust, strengthening farm cash receipts. Higher interest rates and elevated farm input prices seemed to have had minimal influence on the demand for farmland.Our analysis covers the period of January 1 to June 30, 2022. The highest increases were observed in Ontario, Prince Edward Island and Quebec, with 15.6%, 14.8% and 10.3% increases, respectively. Saskatchewan follows with an 8.4% average increase. British Columbia, Alberta, Manitoba, and Nova Scotia recorded below-average increases, varying from 5.9% to 6.5%. New Brunswick has the smallest increase, with a reported 3.4%.

Table 1. Average farmland values changes in the first half of 2022 by province vs. supply of arable land

Sources: FCC computations and Statistics Canada

Timing of sales, tight supply and farm income all matter in the context of higher borrowing costs

The Bank of Canada started lifting its policy interest rate in early March. But this was a muted response to emerging inflationary pressures. It wasn’t until July that the Bank of Canada frontloaded the required hikes in the overnight rate to bring down inflation. It’s important to note that many sales were negotiated or closed before the significant borrowing costs increases. It’s not rare for transactions to close multiple months after being negotiated.

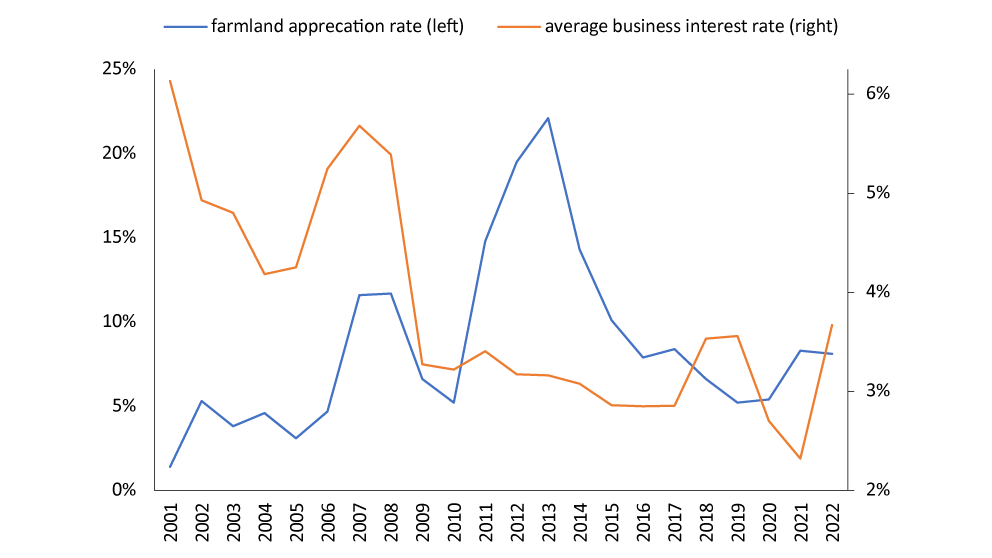

FCC has been reporting on farmland values since 1985. Historically, we’ve seen other periods of rising interest rates – the previous significant increase occurred in 2006-07 (Figure 1). Yet, this period coincided with increases in the appreciation rate of farmland values, highlighting the importance of considering factors beyond borrowing costs.

Figure 1. Average farmland values appreciation rate with average business interest rates

Sources: FCC computations and Bank of Canada; 2022 represents an average of the first 6 months.

The acreage available for farmland that can be cultivated and productive is limited and does not increase as opposed to real estate markets. This puts upward pressure on prices, given a stable and robust demand. The percentage of land used as arable land is limited in most provinces (Table 1). Recently, provinces with more arable land seemed to experience a slower pace of increase in land values.

Farm cash receipts have climbed 14.6% year-over-year for the first half of 2022. Grain, oilseed, and pulse receipts were slightly lower in the first six months, but this was expected given the poor 2021 crop in the Prairies. The outlook remains positive. Despite inflationary pressures and geopolitical tensions, new crop prices continue to exceed early expectations, and margins should be profitable, given encouraging 2022 production estimates.

Provincial trends

In British Columbia, land values increased by an average of 6.5% for the first half of 2022. Increases varied a lot across the province, with the highest changes mostly located in areas with easy access and close to urban centers. We observed strong competition between farm operations and non-traditional buyers.Alberta farmland increased at a more moderate pace of 5.9% for the first six months of 2022. It’s important to note that this increase applies to dryland only, and irrigated land values are only provided in the annual report. Farmland availability remains low in this province... Read More

Sign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.