Tighter grower margins cloud crop input market

Thursday, August 29, 2024

Reference: FCC

Harvest is only beginning, and yes it’s not too early to think about next year’s crop inputs. Uncertainty and risks abound in the ag markets, so input manufacturers and retailers are already planning ahead. Farm profitability is under pressure because commodity prices are below their 5-year average due to strong U.S. production, while input costs remain high. Although some input prices have dropped, they haven’t declined as much as grain and oilseed revenues. Canadian crop input sales peaked at $23.4 billion in 2022 and have stayed around $20 billion in recent years (Figure 1). We expect sales to remain flat for next year’s crop.

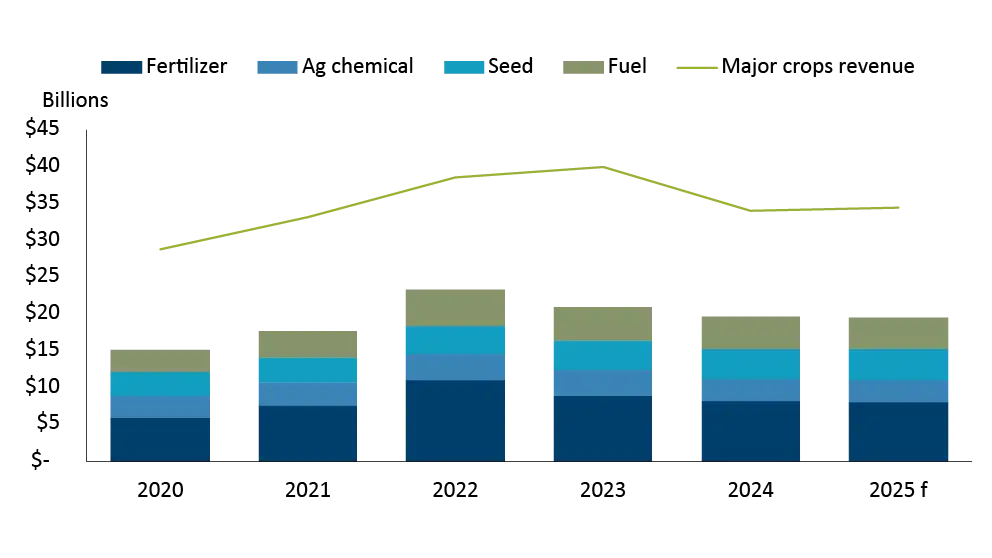

Harvest is only beginning, and yes it’s not too early to think about next year’s crop inputs. Uncertainty and risks abound in the ag markets, so input manufacturers and retailers are already planning ahead. Farm profitability is under pressure because commodity prices are below their 5-year average due to strong U.S. production, while input costs remain high. Although some input prices have dropped, they haven’t declined as much as grain and oilseed revenues. Canadian crop input sales peaked at $23.4 billion in 2022 and have stayed around $20 billion in recent years (Figure 1). We expect sales to remain flat for next year’s crop.Tighter margins make it important to optimize the crop and input mix for next season. Early planning can help take advantage of early bird discounts and allow flexibility to adjust plans as new information becomes available. Here is our initial assessment of factors that might affect the crop input market next year. This information aims to help producers and the crop input sector make informed decisions about managing expenses and maintaining appropriate inventories.

Figure 1: Canadian crop input sales relative to major crop revenues

Sources: Statistics Canada, FCC calculations

Exceptional U.S. growing conditions drive crop prices lower

This year, U.S. farmers are experiencing excellent growing conditions, leading to record yields for corn and soybeans. This abundance is pushing commodity prices down. If Canada has an average production year, the lower prices could result in negative net returns for some farms, depending on their land costs. As grain and oilseed prices drop, farmers might feel more anxious about making decisions for next year’s inputs, with tighter expected profitability and reduced cash flow.Input expenses softer but remain high

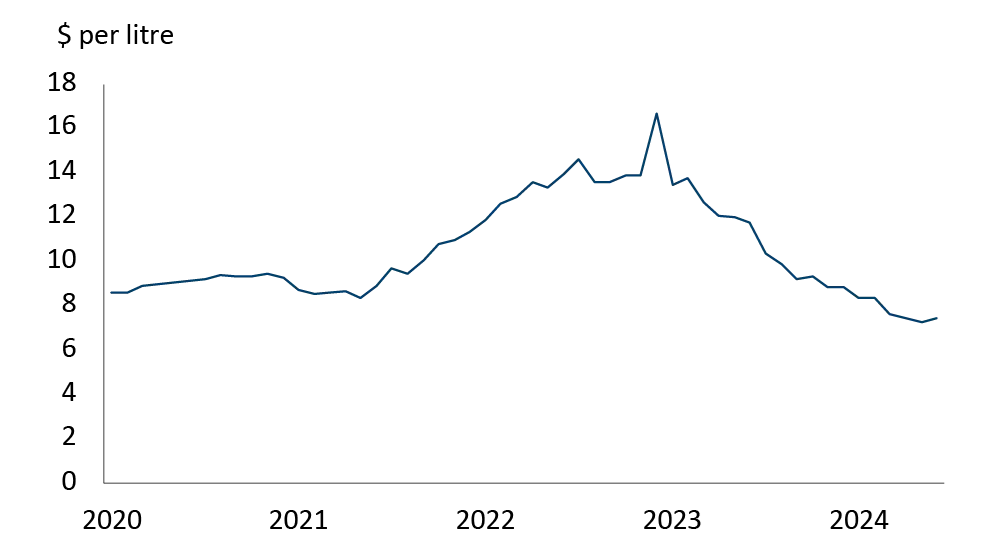

On the positive side, chemical prices have eased. The prices of key active ingredients have fallen as the sector recovers from post-pandemic supply chain issues. Global inventories of most chemicals, like glyphosate, have increased, leading to price drops (Figure 2). Consequently, agricultural chemical sales are expected to decline by 14% in 2024 and another 4% the following year due to these lower prices.Figure 2: Glyphosate prices continue to be pressured by global inventories

Sources: Alberta farm input prices, FCC calculations

Global fertilizer demand subdued but prices remain elevated

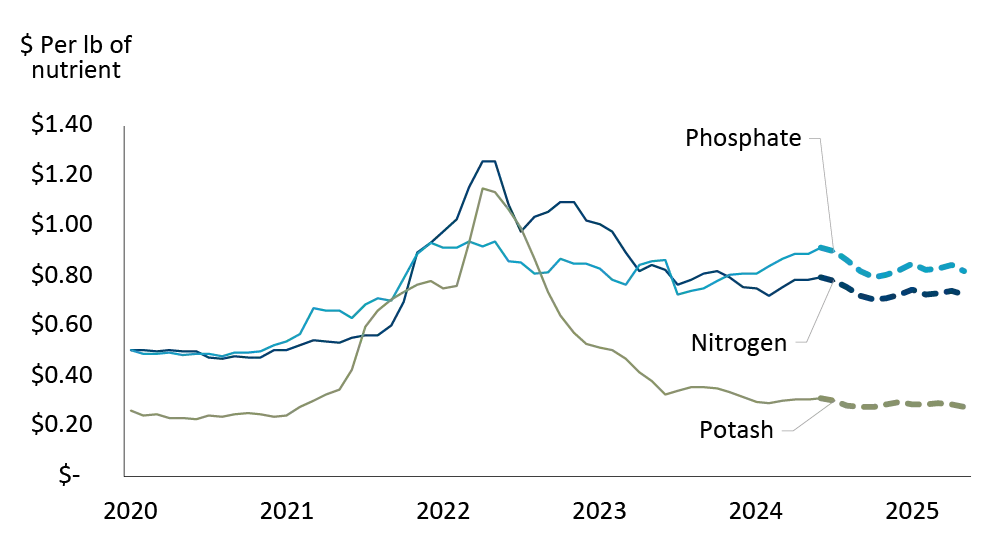

Fertilizer prices have dropped a lot since their peak in 2022 and have continued to go down since the 2024 planting season started. The demand for fertilizers, especially nitrogen, has been lower globally. This is good news for farmers, but prices are still higher than they were before 2022 (Figure 3). There’s a chance prices could go up again for next year’s crops. Global issues like China’s export restrictions and paused production in Egypt are keeping prices high. However, China’s export decisions are unpredictable. On the flip side, if global crop prices keep falling, it could lead to even lower fertilizer prices.

Figure 3: Fertilizer prices trending side-ways but upside risk present for next year

Sources: Alberta farm input prices, FCC calculations

Fuel and seed sales

Fuel prices can change a lot due to global market conditions and events like conflicts. They are expected to go down as the global economy slows. We think farmers will spend 3.6% less on fuel next year. Sales of commercial seeds are expected to go up by 5% in 2025 because of higher prices for hybrid seeds like canola, soybeans, and corn. Prices for pedigreed seeds like cereals and pulses should stay stable since they follow crop market prices more closely.

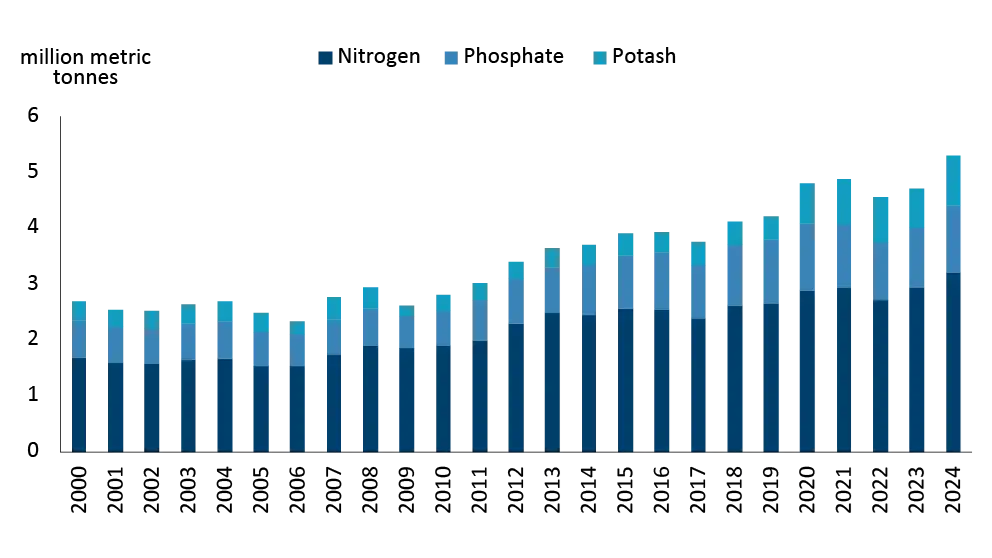

Growing the role of crop input providers

With tighter profit margins, farms will be more careful about what crops to plant and how much fertilizer and chemicals to use. Services that add value, like expert advice and agronomics, will keep growing in the long run. In the short term, lower farm revenues will make farmers rethink their strategies. Agriculture retailers and suppliers will play a big role in helping farmers increase productivity, using the same or fewer inputs. However, crop input retailers need to know how much inventory to order for the next year.The main concern for the coming year is the demand for domestic fertilizer. The amount of land used for specific crops greatly affects fertilizer use by Canadian farmers. Fertilizer use also changes with profitability, moisture conditions, and soil nutrients. Due to profitability pressures and recent moisture conditions, farmers might use less fertilizer. Historically, farms have reduced fertilizer use during or after years with low revenue or production issues like drought or excessive moisture. For example, in 2005 and 2006, margins were low, and in 2022 and 2023, high fertilizer prices led to reduced use. Soil testing and planning crop inputs are just as important as marketing plans for profitability.

Figure 4: Fertilizer use ebbs and flows

Sources: Statistics Canada, FCC calculations

Bottom line

The 2025 farm input market will depend on how much farm income is under pressure. Lower farm revenue this year and next will reduce the demand for crop inputs. Farmers make decisions based on the information they have at the time. Fall is the best time for farmers and crop input retailers to review their return on investment and plan for the next year. The crop input sector can play a bigger role by helping farms better plan their input needs for the year ahead. Working together will increase productivity and improve farm profitability.

Read More

Sign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.